Andrew’s Pitchfork is a technical tool that helps to identify possible support and resistance levels as well as potential breakout and breakdown levels with three parallel trend lines that look like a pitchfork.

This tool, developed by Alan Andrews, uses trend lines that are created by selecting three points placed at three consecutive peaks and troughs at the start of confirmed trends, higher or lower.

Once the points are placed, a straight line denoting the median line is drawn from the first point through the midpoint between the upper and lower points. Upper and lower trend lines are then drawn automatically parallel to the median line.

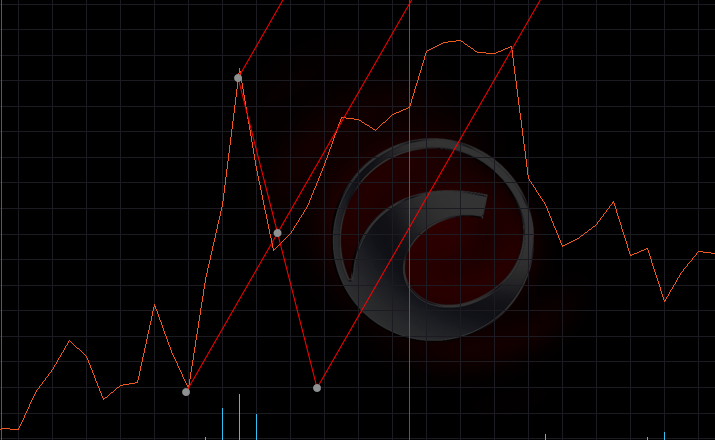

Andrew’s Pitchfork is built by the following scheme – Point 1 is a starting point of the central trendline and an uptrend or a downtrend.

Points 2 and 3 are the reaction high and low in the uptrend or downtrend, therefore the distance between them is the channel width.

The channel width line is crossed by the central trendline in the Central point.

Andrews Pitchfork is convenient in defining support and resistance. A long position can be entered when the price reaches the bottom trend line.

On the contrary, a short position can be entered when the price hits the upper trend line. The profits may be booked when the price reaches the opposite side of the pitchfork.

Before entering a position, one should make sure that support and resistance are stalling at these levels. Price should reach the median trend line frequently when a security is trending and, when that doesn’t happen, it may indicate an acceleration in the trend.

Also, Andrew’s Pitchfork can be used to trade breakouts (above the upper trend line) and breakdowns (below the lower trend line).

But in this situation, one should pay extra attention to the head fakes and apply indicators (such as On Balance Volume for example) to estimate the strength or weakness of the breakout or breakdown.

Note that one should have special skills and experience to use this tool, as selecting the most reliable three points is crucial when it comes to the effectiveness of the indicators you will use, which depends on those points.

Traders and investors can optimize this task by experimenting with different reactionary highs and lows, constructing and reconstructing the indicator to identify the most effective price points.

In Ananda you have preset Andrew’s Pitchfork instrument in your toolbar, that allows drawing the tool on the chart, moving it, rotating, and configuring depending on your needs.

You can find a detailed description of how to use it in the Line Studies section of this documentation.