The Depth of Market is a measure of the total amount of the open Buy and Sell orders for a symbol at different prices.

The higher the number of Buy and Sell orders at each price, the higher the Depth of Market is.

The Ananda DoM feature allows tracking the Depth of Market of a required symbol in real-time and placing orders using the particular DoM settings.

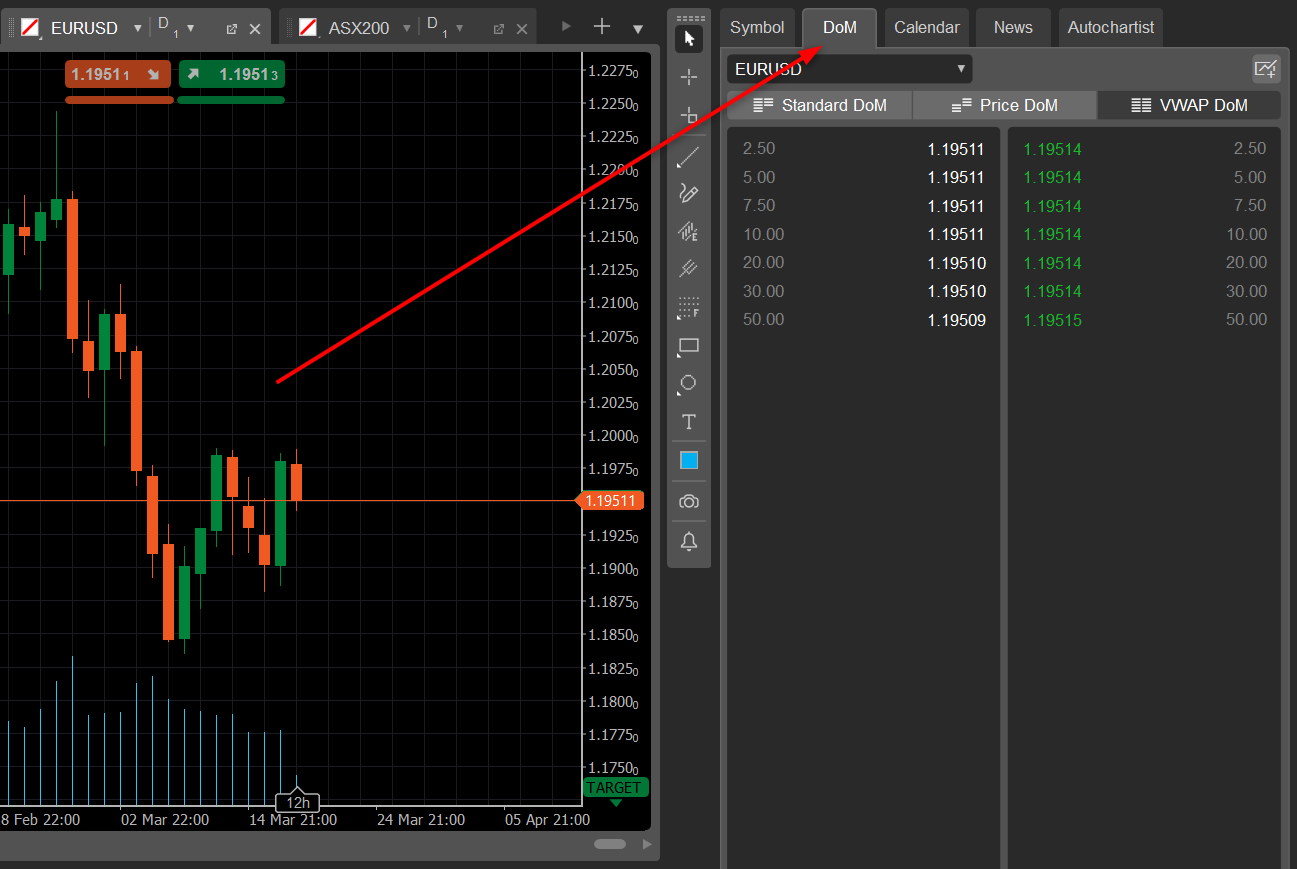

Proceed to the DoM tab to the upper right to get to the Depth of Market section of a symbol.

Types of DoM #

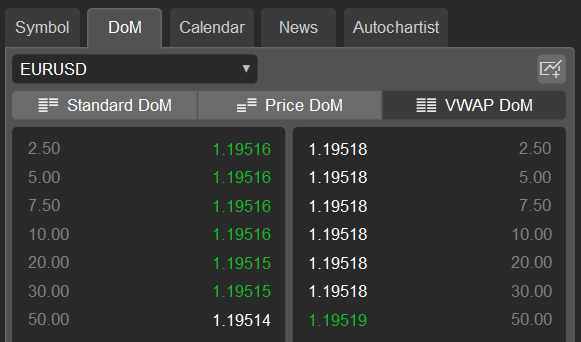

There are three types of the Depth of Market available in Ananda: the Standard DoM, the Price DoM, and the VWAP DoM.

Standard DoM #

By default, the Depth of Market is displayed in the Standard view. Click Standard DoM to switch to the Standard from any other view.

The Standard Dom displays the price and the amount of the liquidity available at that price. The Standard DoM allows viewing the current Depth of Market but doesn’t allow trading.

Price DoM #

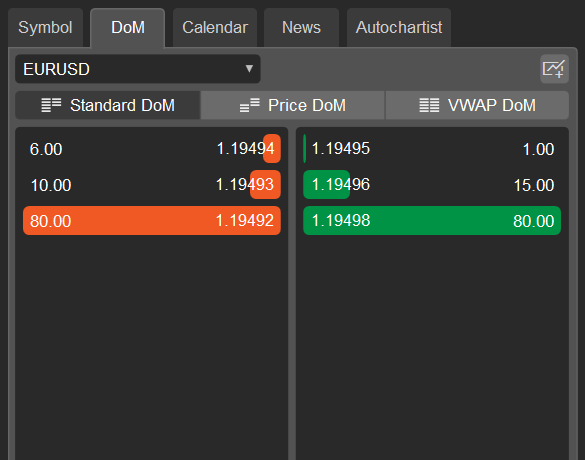

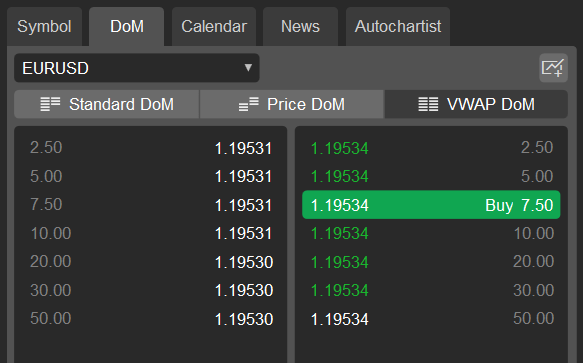

Click Price DoM to switch to the Price DoM view.

It is the ideal view for the precise trading as it displays more details, allows entering a trade with Buy or Sell Stop and Limit Orders and managing open positions directly in the Depth of Market table.

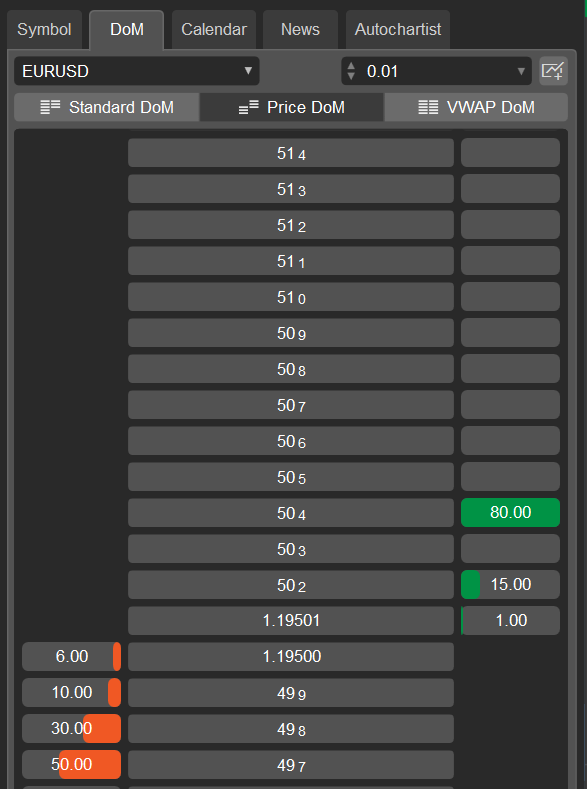

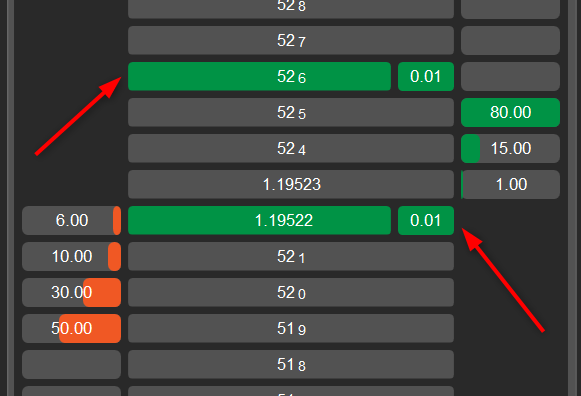

The price is represented by the widest column in the center when you hover the cursor over the Price DoM table.

The volume available for trade appears right next to the corresponding price.

Selling volumes are to the left and buying volumes are to the right from the price, colored orange and green respectively when you hover over them.

Only the current Bid and Ask prices are displayed completely, all the other prices are represented with only three last digits of the Bid/Ask price (see the image above).

The last digit is a point – 0.1 of the pip.

Trading in the Price DoM #

To enter a trade:

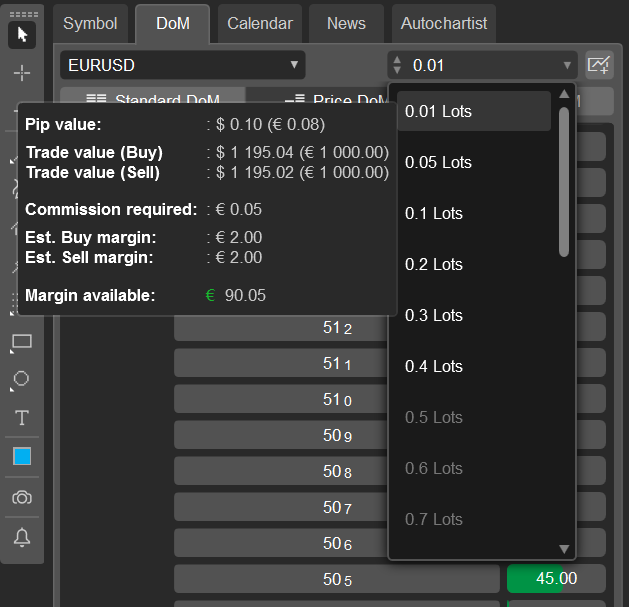

1. Select the required symbol and the volume to trade from the drop-down above the Depth of Market table.

Note

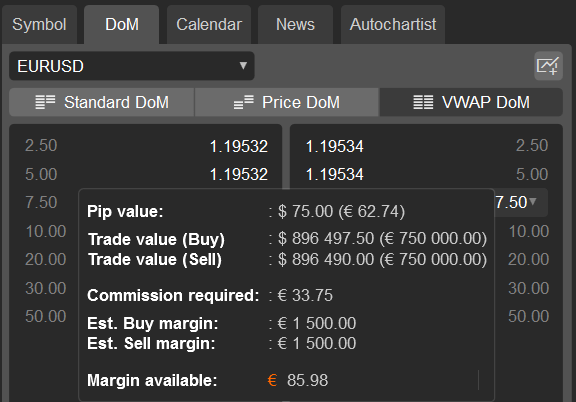

When you hover over the traded amount, the order details like Pip value, trade value, commission, etc. will be calculated automatically and displayed in the pop-up.

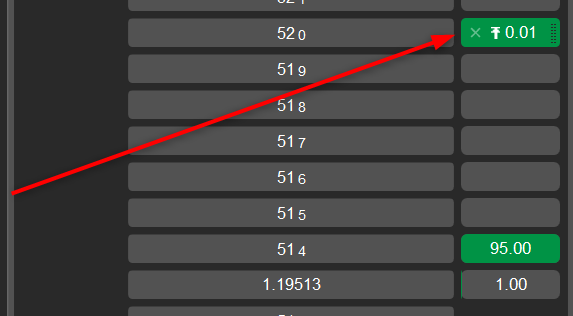

2. Click Sell Stop to the left or Buy Stop to the right of the required price to place a Sell Stop Order or a Buy Stop Order respectively. The orders will be placed and you will see them right away directly in the Price DoM table.

To delete an order click the cross. To modify an order, drag it up or down in the table.

Note

You cannot change an order type by dragging and dropping in the DoM table. You can only change the price.

When a pending order is filled, a position is created. You can see the open positions directly in the Price DoM table.

Use the Close buttons to the bottom of the Price DoM to Close all the Orders or Positions of a required type at once.

VWAP DoM #

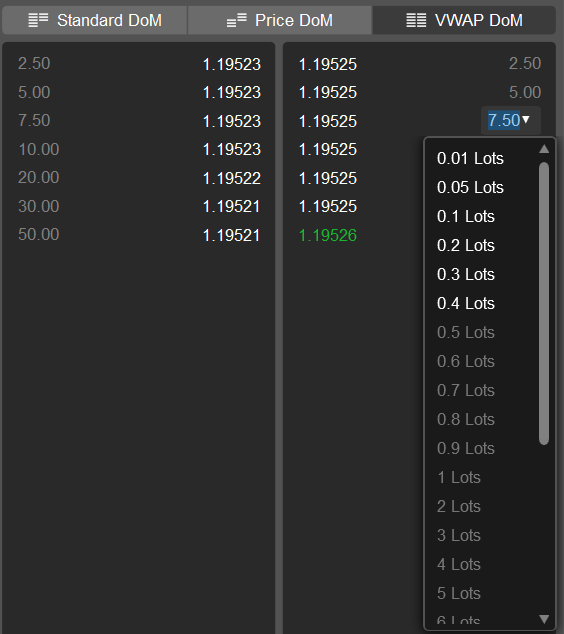

Click VWAP DoM to switch to the VWAP (volume-weighted average price) DoM view. You can see the list of the expected VWAP prices next to the list of the adjustable volumes.

VWAP DoM is especially useful when trading large volumes because it shows an average price for the volume traded. Ananda allows you to enter a trade directly in the VWAP DoM table.

Note

When you hover over the lots amount, the order details like Pip value, trade value, commission, etc. will be calculated automatically and displayed in the pop-up.

Trading in the VWAP DoM #

1. Select the required order volume from the drop-down (alternatively, type it in or use the toggles).

2. Click on the price to the left to create a Sell Order or to the right to create a Buy Order respectively.

Note

If the QuickTrade mode is disabled, then the Create Order dialog box will pop up. With QuickTrade enabled, an order will be sent without any confirmations according to the current QuickTrade settings.